Meta Description: Discover the top 10 budgeting software tools for 2026! Compare features, pros, cons, and pricing to find the best budgeting solution for you.

Introduction

In 2026, budgeting software has become an indispensable tool for individuals, small businesses, and large enterprises aiming to manage finances effectively. These tools help track income, expenses, and savings, offering insights to optimize financial decisions. With economic uncertainties and evolving financial regulations, budgeting software provides real-time data, automation, and forecasting to ensure users stay ahead. When choosing a budgeting tool, prioritize ease of use, integration with financial accounts, robust reporting, and scalability to meet your needs. Whether you’re a freelancer, a startup, or a CFO, the right software can streamline financial planning and reduce manual errors. This blog explores the top 10 budgeting software tools for 2026, detailing their features, pros, cons, and a comparison to help you make an informed choice.

Top 10 Budgeting Software Tools for 2026

1. YNAB (You Need A Budget)

Description: YNAB is a personal finance app focused on zero-based budgeting, empowering users to assign every dollar a job. Ideal for individuals and small households seeking to transform their financial habits.

Key Features:

- Zero-based budgeting framework

- Bank account syncing for real-time tracking

- Goal tracking for savings and debt payoff

- Detailed reports and visualizations

- Free 34-day trial

- Mobile and web apps

- Educational resources and workshops

Pros:

- Encourages disciplined budgeting

- Intuitive interface, especially for millennials

- Strong community support and tutorials

Cons:

- Subscription cost ($14.99/month or $99/year) may deter some

- Steep learning curve for new budgeters

- Limited investment tracking features

2. Rocket Money

Description: Rocket Money is a versatile budgeting app with premium features like bill negotiation and subscription management. It’s perfect for users seeking an all-in-one financial tool.

Key Features:

- Subscription and bill tracking

- Bill negotiation service

- Credit score monitoring

- Net worth and spending insights

- Customizable budget categories

- Real-time bank syncing

- Premium chat support

Pros:

- Free plan available

- Excellent subscription management

- High user ratings (4.7/5 on Android, 4.5/5 on iOS)

Cons:

- Premium features require subscription ($4–$12/month)

- Limited functionality on free plan

- Bill negotiation success varies

3. Monarch Money

Description: Monarch Money offers comprehensive budgeting and net worth tracking, ideal for users replacing Mint or seeking customizable financial dashboards.

Key Features:

- Customizable dashboards and widgets

- Bank, credit card, and investment syncing

- Collaborative budgeting for couples

- Spending forecasts and savings goals

- Debt paydown tools

- iOS (5.0/5) and Android (4.5/5) apps

- No free plan, but 7-day trial

Pros:

- Robust transaction management

- Clean, user-friendly interface

- Great for joint financial planning

Cons:

- No free version ($8.33–$14.99/month)

- Limited mobile app functionality

- Some accounts struggle to stay connected

4. Quicken Simplifi

Description: Quicken Simplifi is a streamlined budgeting app designed for users who want automated budget creation and multi-device access.

Key Features:

- Automatic budget setup based on spending

- Bank and loan account syncing

- Custom spending reports

- Financial roadmap for goal tracking

- Bill payment reminders

- Multi-device access (phone, tablet, desktop)

- 30-day free trial

Pros:

- Beginner-friendly with minimal setup

- Excellent dashboard for quick insights

- Supports both Windows and macOS

Cons:

- Subscription fee ($3.99/month or $47.88/year)

- Glitches reported in mobile app

- Encourages ignoring some spending, which may undermine budgeting

5. PocketGuard

Description: PocketGuard is a zero-based budgeting app that helps users track spending and manage debt, ideal for those seeking simplicity and debt payoff tools.

Key Features:

- Zero-based budgeting

- Debt payoff planning tool

- Subscription cancellation support

- Net worth and savings trackers

- Custom spending categories

- Bank and investment syncing

- Bill negotiation via Billshark

Pros:

- Free plan available

- Strong debt management features

- User-friendly for beginners

Cons:

- Premium plan ($7.99/month or $79.99/year) needed for full features

- Some features overlap with Rocket Money

- Limited advanced budgeting options

6. EveryDollar

Description: EveryDollar, created by Ramsey Solutions, is a zero-based budgeting app tailored for users following Dave Ramsey’s financial principles.

Key Features:

- Zero-based budgeting method

- Bank account syncing (premium)

- Financial roadmap for long-term goals

- Push notifications for bill reminders

- Custom budget reports

- Live Q&A with financial coaches

- Free version available

Pros:

- Free plan for basic budgeting

- Aligns with proven financial philosophy

- Easy to use for beginners

Cons:

- Premium features ($79.99/year) needed for syncing

- Limited investment tracking

- May feel restrictive for non-Ramsey followers

7. Goodbudget

Description: Goodbudget uses a digital envelope system for budgeting, ideal for families and couples who prefer manual control over finances.

Key Features:

- Envelope-based budgeting

- Syncs across devices for shared budgeting

- Customizable expense categories

- Debt tracking and payoff tools

- Free plan with 20 envelopes

- Mobile and web access

- No bank syncing on free plan

Pros:

- Free plan is robust

- Great for collaborative budgeting

- Simple, intuitive design

Cons:

- Premium plan ($10/month or $80/year) for unlimited envelopes

- No bank syncing on free plan

- Limited advanced features

8. Lunch Money

Description: Lunch Money is a web-first budgeting app with advanced features like multicurrency support, perfect for digital nomads and desktop users.

Key Features:

- Multicurrency support

- Crypto portfolio syncing

- Rules engine for transaction categorization

- Customizable budget categories

- Detailed financial reports

- iOS (5.0/5) and Android (4.5/5) apps

- $10/month or $50–$150/year (set your price)

Pros:

- Advanced features for complex finances

- Flexible pricing model

- Strong desktop experience

Cons:

- No free plan

- Mobile app has limited functionality

- Fewer user reviews due to niche focus

9. Empower

Description: Empower combines budgeting with investment and net worth tracking, ideal for users wanting a holistic view of their finances.

Key Features:

- Free budgeting and investment tracking

- Net worth and portfolio trackers

- Customizable spending categories

- Bank, credit card, and IRA syncing

- Retirement planning tools

- Spending snapshot reports

- Multi-user dashboard sharing

Pros:

- Completely free

- Strong investment tracking

- User-friendly dashboard

Cons:

- Limited advanced budgeting features

- Ads in free version

- Less focus on zero-based budgeting

10. Abacum

Description: Abacum is a business budgeting platform designed for mid-sized companies, offering robust integration and scenario planning.

Key Features:

- Advanced scenario planning

- Integration with ERP, CRM, and HRIS

- Automated report compilation

- Flexible financial modeling

- User-friendly interface

- Real-time data consolidation

- 14-day free trial

Pros:

- Ideal for growing businesses

- Strong automation reduces errors

- Excellent customer support

Cons:

- Pricing starts at $10,000/year, limiting accessibility

- Desktop UI feels outdated

- Requires training for full utilization

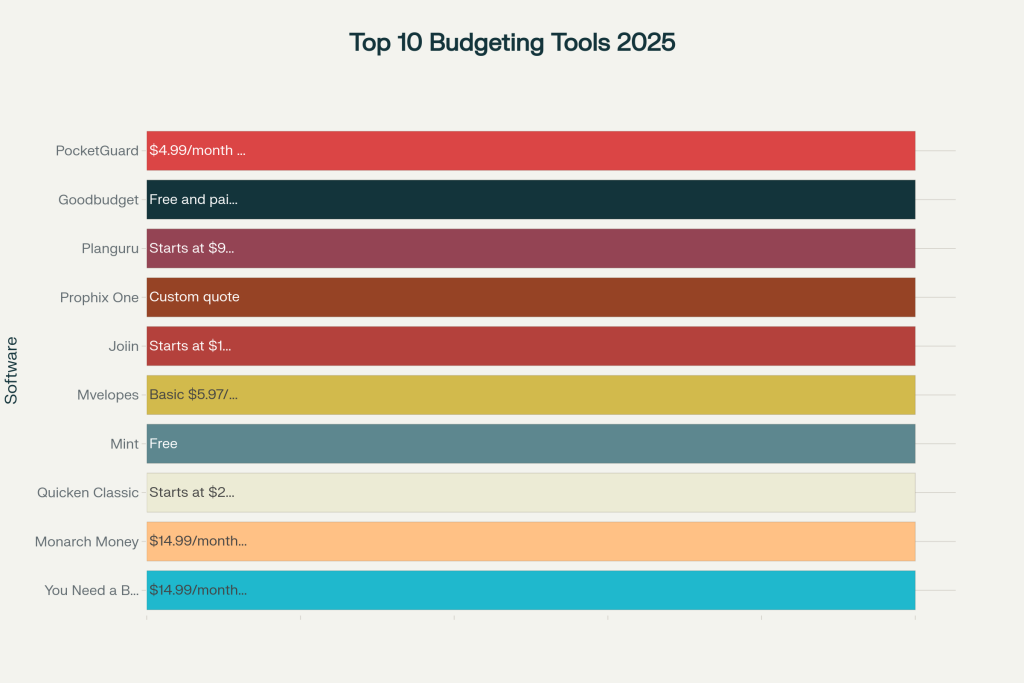

Comparison Table

| Tool Name | Best For | Platform(s) Supported | Standout Feature | Pricing | Rating |

|---|---|---|---|---|---|

| YNAB | Personal zero-based budgeting | Web, iOS, Android | Zero-based budgeting framework | $14.99/month or $99/year | 4.7/5 (Trustpilot) |

| Rocket Money | All-in-one financial management | iOS, Android | Bill negotiation | Free / $4–$12/month | 4.7/5 (Android) |

| Monarch Money | Couples, Mint replacements | Web, iOS, Android | Customizable dashboards | $8.33–$14.99/month | 4.5/5 (Android) |

| Quicken Simplifi | Automated budgeting | Web, iOS, Android, Desktop | Automatic budget setup | $3.99/month or $47.88/year | 4.5/5 (Capterra) |

| PocketGuard | Debt management, simplicity | iOS, Android | Debt payoff planning | Free / $7.99/month | 4.6/5 (Google Play) |

| EveryDollar | Ramsey followers, beginners | Web, iOS, Android | Financial roadmap | Free / $79.99/year | 4.7/5 (App Store) |

| Goodbudget | Envelope budgeting, families | Web, iOS, Android | Digital envelope system | Free / $10/month | 4.6/5 (Google Play) |

| Lunch Money | Digital nomads, desktop users | Web, iOS, Android | Multicurrency support | $10/month or $50–$150/year | 4.5/5 (Android) |

| Empower | Investment-focused budgeting | Web, iOS, Android, Desktop | Net worth tracking | Free | 4.4/5 (App Store) |

| Abacum | Mid-sized businesses | Web, Desktop | Scenario planning | Starts at $10,000/year | 4.6/5 (G2) |

Which Budgeting Software Tool is Right for You?

Choosing the right budgeting software depends on your needs, budget, and technical comfort level. Here’s a decision-making guide:

- Individuals and Freelancers: YNAB or EveryDollar are excellent for personal budgeting, especially if you prefer zero-based budgeting. YNAB suits those willing to invest time in learning, while EveryDollar is ideal for beginners or Ramsey followers. Empower is a great free option for those focused on investments.

- Couples and Families: Monarch Money and Goodbudget excel for collaborative budgeting. Monarch offers robust syncing and customization, while Goodbudget’s envelope system is perfect for manual budgeting enthusiasts.

- Digital Nomads and Expats: Lunch Money’s multicurrency support makes it ideal for managing global finances, though its desktop focus may not suit mobile-first users.

- Small Businesses: Abacum is tailored for mid-sized companies needing advanced forecasting and integration. Smaller teams might prefer Quicken Simplifi for its simplicity and affordability.

- Debt-Focused Users: PocketGuard and Rocket Money offer strong debt management and subscription tracking, with PocketGuard being more debt-specific.

- Budget-Conscious Users: Empower and Goodbudget’s free plans are great for those avoiding subscription costs, though premium features may require payment.

Consider your financial goals, whether you need mobile or desktop access, and if integrations with ERP or banking systems are critical. Most tools offer free trials, so test a few to find the best fit.

Conclusion

In 2026, budgeting software is more critical than ever, offering automation, real-time insights, and tailored financial strategies for individuals and businesses. The landscape is evolving with AI-driven analytics, seamless integrations, and user-friendly interfaces, making financial management accessible to all. From YNAB’s disciplined zero-based budgeting to Abacum’s enterprise-grade forecasting, these tools cater to diverse needs. Try demos or free trials to explore features firsthand and choose a tool that aligns with your financial goals. With the right software, you can take control of your finances and plan confidently for the future.

FAQs

Q: What is budgeting software?

A: Budgeting software helps users track income, expenses, and savings, offering tools for budgeting, forecasting, and financial reporting to optimize money management.

Q: Are there free budgeting apps available in 2026?

A: Yes, Empower and Goodbudget offer free plans, while Rocket Money and EveryDollar provide free versions with limited features.

Q: Which budgeting tool is best for small businesses?

A: Abacum is ideal for mid-sized businesses with advanced needs, while Quicken Simplifi suits smaller teams due to its affordability and ease of use.

Q: Can budgeting apps sync with bank accounts?

A: Most apps, like YNAB, Monarch Money, and Rocket Money, sync with bank accounts for real-time transaction tracking, though some require premium plans.

Q: How do I choose the right budgeting software?

A: Consider your budget, financial goals, preferred platform (mobile or desktop), and features like bank syncing, debt tracking, or forecasting. Test free trials to ensure a good fit.